Need a tax benefit that also supports our community?

Your gift to the Welcome House Recovery Center construction project may be eligible for a significant tax credit AND help us complete the final phase of our construction project!

The Affordable Housing Assistance Program (AHAP) housing production tax credit is used as an incentive for Missouri businesses and/or individuals to support the accessibility of affordable housing in our community. In this case, Welcome House is doing just that through our residential-based recovery services.

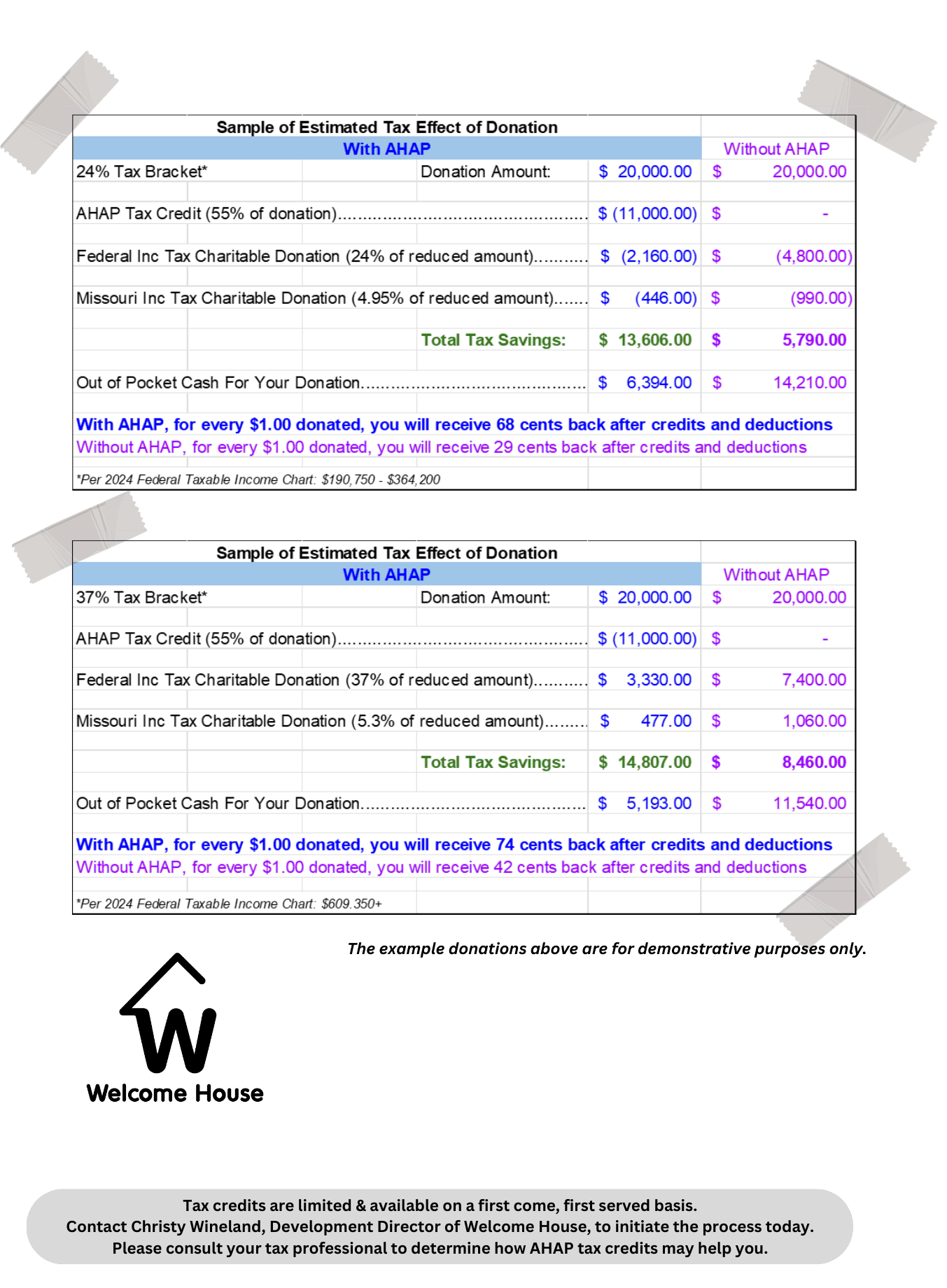

Up to $3.2 million in eligible donor contributions can be awarded AHAP tax credits. Eligible gifts of any amount must be received by April 1, 2025. Best of all, these donors will receive 55% of their eligible donation value as a tax credit! Additionally, the credits:

- are fully transferable.

- can be used immediately or rolled forward up to 10 years without penalty.

- may be applied dollar-for-dollar against liability for Missouri taxes.*

Our Project: The final construction phase of the Welcome House Recovery Center is currently underway. This 100+ bed facility, offers safe accommodations, along with a highly structured recovery program and supportive services.

|

Eligibility: Donor(s) who have Missouri tax liability from business activities performed within Missouri. This includes corporations, partnerships, banks, insurance companies, foundations, sole proprietorships, and individuals receiving rental, royalties, and/or farm income.* Eligible Gifts: A gift that is or can be converted to a cash value prior to April 1, 2025, including cash, stock, real estate, professional services, and/or in-kind goods. Gift must be eligible for the federal income tax charitable deduction. * |

|

Issuance of Tax Credit Certificate: To initiate, contact Christy Wineland at: 816-472-0760 ext. 511 Once your eligible gift is received, you’ll sign a certification form and Welcome House will submit the application to Missouri Housing Development Commission (MHDC) for approval and issuing your tax credit certificate. |